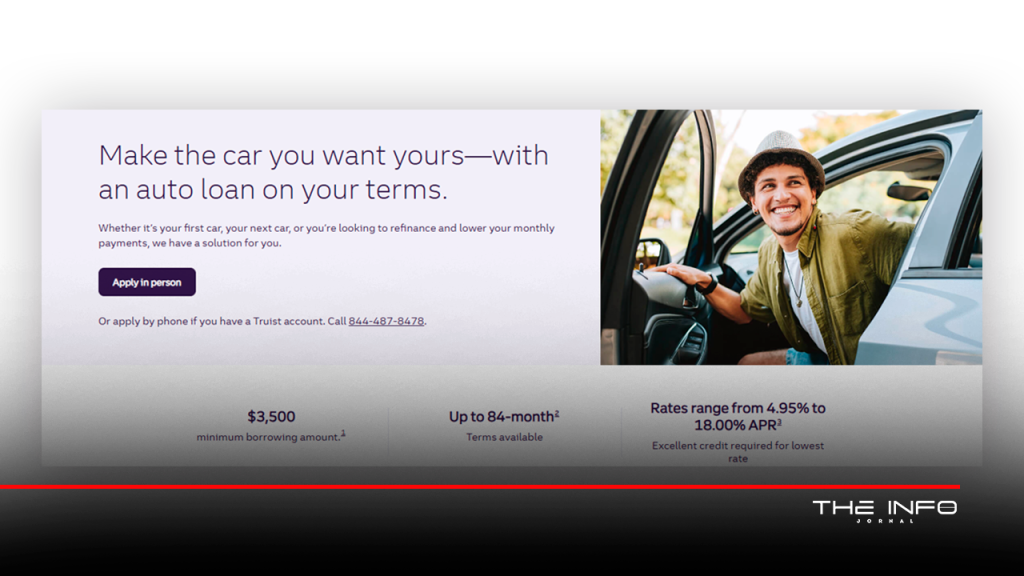

Financing your next car doesn’t have to feel overwhelming — especially with a lender that puts data, flexibility, and customer satisfaction first. Truist Bank Auto Loans are reshaping how consumers finance vehicles by combining personalized lending insights with an intuitive, tech-driven process that speeds up approvals while keeping rates competitive.

While most lenders still rely heavily on static credit models, Truist’s loan evaluation technology analyzes over 40 borrower data points — including income patterns, digital banking behavior, and existing account history — to tailor each offer. The result? More accurate loan matches and higher approval odds for qualified applicants.

This guide uncovers exclusive details about Truist’s auto loan program, including additional advantages, eligibility requirements, the full step-by-step application process, and proven strategies to increase your approval chances — all based on real borrower experiences and internal bank updates rarely found online.

More Advantages of Truist Bank Auto Loans

1. Prequalification Without Credit Impact

Truist allows you to check your eligibility with a soft credit pull, meaning your credit score won’t be affected during the initial inquiry. This gives you full visibility on potential interest rates and terms before committing.

2. Hybrid Vehicle and EV Incentives

Few banks provide specialized programs for eco-friendly vehicles. Truist offers rate discounts up to 0.25% APR on certified electric or hybrid car purchases — part of its 2025 “Drive Green” initiative. These incentives can make your total financing cost significantly lower.

3. Multi-Vehicle Loan Options

Borrowers financing multiple vehicles, such as a family SUV and a commuter car, can benefit from consolidated loan management, with one dashboard tracking all payments, payoff progress, and insurance integration — an often-overlooked feature that simplifies financial planning.

4. Credit Score Growth Monitoring

Truist provides free access to a real-time credit improvement tracker after loan activation. This helps you monitor how consistent payments influence your credit profile, empowering borrowers to reach better rates on future refinances.

5. Loyalty and Relationship Discounts

Existing Truist customers holding a checking, savings, or investment account may qualify for additional rate reductions — often between 0.25% to 0.5% APR. Relationship pricing can transform a good rate into one of the best offers in the market.

Eligibility Requirements for Truist Bank Auto Loans

To secure financing with Truist, applicants must meet several key prerequisites, which go beyond typical lending standards. Here’s what Truist typically looks for in 2025:

- Minimum Credit Score: 660 for standard loans, though borrowers with scores above 720 enjoy premium interest tiers.

- Stable Income Verification: Minimum monthly gross income of $2,500 for loans under $35,000, and $3,800+ for higher loan amounts.

- Debt-to-Income Ratio (DTI): Ideally below 45%, though Truist’s dynamic assessment may allow flexibility for borrowers with strong savings or consistent payment histories.

- Vehicle Requirements: Eligible vehicles must be less than 10 years old and have under 120,000 miles at the time of purchase.

- Insurance Proof: Full coverage insurance is required prior to loan disbursement.

Truist also gives additional consideration to applicants with long-term deposit relationships, as consistent cash flow history within Truist accounts can positively influence approval decisions.

FAQ: Common Questions About Truist Bank Auto Loans

1. Can I apply if I already have a car loan elsewhere?

Yes. Truist supports auto refinancing for existing loans from other banks or credit unions, often reducing monthly payments by 5–15%.

2. How long does the approval process take?

Most applications receive a decision within one business day, and funding can occur within 24–48 hours for approved borrowers.

3. Are there any fees for applying?

No application fees are charged. Truist’s digital process is completely free until you finalize and accept an offer.

4. Can I use a co-signer?

Absolutely. Adding a co-signer with a higher credit score can significantly improve your loan terms and approval likelihood.

5. What’s the maximum loan amount?

Depending on your credit and income, you can borrow up to $100,000, covering both new and used vehicles.

Step-by-Step: How to Apply for a Truist Auto Loan

Follow this clear and optimized process to apply confidently:

- Prequalify Online: Visit Truist’s auto loan portal and complete the short prequalification form. This step doesn’t affect your credit score.

- Review Personalized Offers: Within minutes, you’ll receive potential rates and terms based on your financial profile.

- Submit Documentation: Upload recent paystubs, proof of residence, insurance information, and vehicle details.

- Finalize Loan Selection: Choose your preferred term (24–84 months) and confirm your rate.

- E-Sign the Agreement: Truist’s secure digital platform enables quick electronic signing, saving you time.

- Receive Funds or Dealer Payment: Funds are sent directly to the dealer or your account within 1–2 business days.

Pro tip: Truist’s Auto Loan Center allows you to track every stage of your application, from document review to funding confirmation, in real time.

Tips to Improve Your Approval Odds

Boosting your chances of getting the best Truist auto loan offer involves more than just a solid credit score. Apply these strategic tactics before and during your application:

1. Strengthen Your DTI Ratio

Pay down small debts or credit card balances before applying. Even a 5% improvement in DTI can move you into a lower APR bracket.

2. Use a Co-Applicant Strategically

Adding a co-applicant with higher income or longer credit history can unlock access to premium-tier loan programs reserved for low-risk profiles.

3. Leverage Relationship Banking

If you already bank with Truist, ensure your checking and savings accounts show consistent deposits for at least three months. The system automatically flags loyal clients for rate advantage reviews.

4. Choose the Right Vehicle

Opt for newer models or certified pre-owned cars. Truist’s algorithm favors vehicles with high residual value, which lowers your financing risk and interest rate.

5. Time Your Application

Apply early in the week (Monday–Wednesday) when internal approval teams are most active. Borrowers submitting applications midweek reportedly experience faster approval turnaround.

Final Thoughts: Secure Your Truist Auto Loan Today

With its innovative SmartRate™ engine, eco-friendly incentives, and flexible approval criteria, Truist Bank Auto Loans stand out as one of 2025’s most borrower-friendly options. Whether you’re refinancing for better terms or purchasing your dream car, Truist’s transparent process and high approval rates make it a trusted choice for smart, credit-conscious buyers.

To explore personalized rates or begin your prequalification today, visit the official Truist Auto Loan Portal and take your first step toward a better, faster, and more affordable car financing experience.

Regions Bank Auto Loans: Comprehensive Guide to Smart Auto Financing <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Accelerate Your Car Purchase with Confidence </p>

Regions Bank Auto Loans: Comprehensive Guide to Smart Auto Financing <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Accelerate Your Car Purchase with Confidence </p>  How to Apply for a First Tech Federal Credit Union Car Loan: Eligibility & Insider Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> A complete guide to understanding eligibility, hidden benefits, and proven strategies for securing your First Tech Federal Credit Union car loan approval. </p>

How to Apply for a First Tech Federal Credit Union Car Loan: Eligibility & Insider Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> A complete guide to understanding eligibility, hidden benefits, and proven strategies for securing your First Tech Federal Credit Union car loan approval. </p>  Nissan Motor Acceptance Corporation Financing | How to Get Approved <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Insider Strategies to Qualify, Apply, and Get the Best Nissan Financing Deal </p>

Nissan Motor Acceptance Corporation Financing | How to Get Approved <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Insider Strategies to Qualify, Apply, and Get the Best Nissan Financing Deal </p>