Securing a car loan can be a pivotal step in achieving your automotive goals. OneMain Financial offers tailored solutions to meet diverse financial needs. Whether you’re purchasing a new or used vehicle, understanding the intricacies of their loan offerings can empower you to make informed decisions.

Additional Benefits of OneMain Financial Car Loans

1. Competitive Loan Amounts

OneMain Financial provides loan amounts ranging from $1,500 to $20,000, accommodating various purchasing needs. For larger loans, the vehicle must be no more than 10 years old and meet specific valuation requirements.

2. Quick Funding Options

Upon loan approval, funds can be disbursed as quickly as one hour after loan closing, ensuring timely access to your financing.

3. Transparent Terms

OneMain Financial offers fixed payments with clear, upfront terms, allowing borrowers to plan their finances effectively.

Prerequisites for Applying

To ensure a smooth application process, consider the following prerequisites:

- Credit Score: Minimum of 600–650.

- Documentation: Proof of identity, residence, and income.

- Collateral: Vehicle must be titled in your name, have valid insurance, and meet valuation requirements.

- Vehicle Age: For larger loans, the vehicle should be no more than 10 years old.

Frequently Asked Questions

1. What types of vehicles are eligible for financing?

Eligible vehicles include cars, trucks, and motorcycles. Other titled vehicles like boats, RVs, and trailers may also be considered.

2. Can I apply for a loan if I have less-than-perfect credit?

Yes, OneMain Financial offers second-chance auto loans to individuals with less-than-perfect credit.

3. How long does the approval process take?

Approval timelines can vary, but funds may be available as quickly as one hour after loan closing.

Step-by-Step Guide to Applying

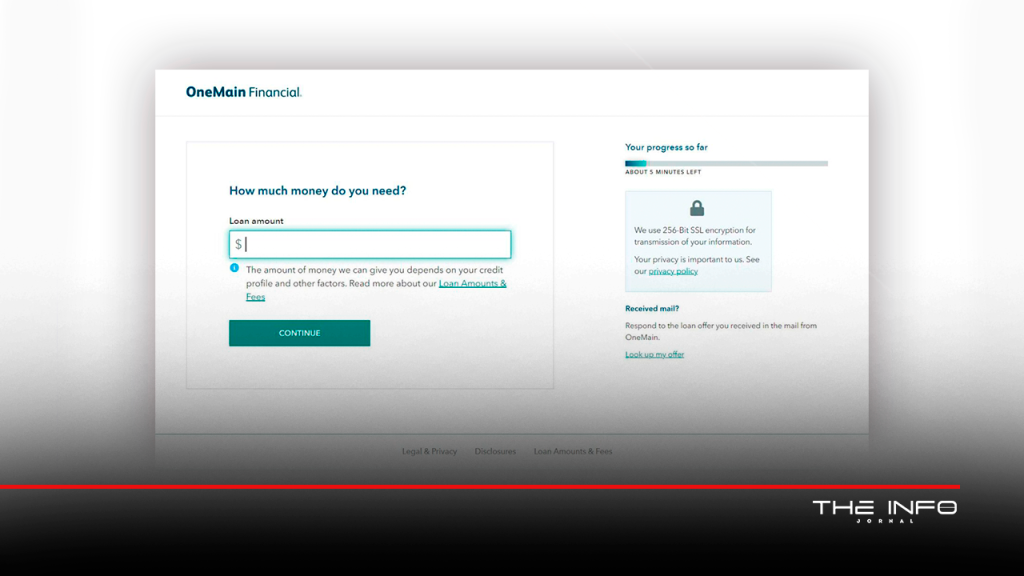

- Prequalification: Visit the OneMain Financial website to check for prequalified offers.

- Application: Complete the online application form with accurate information.

- Documentation: Upload required documents, including proof of identity, residence, and income.

- Approval: Await loan approval, which may take up to one business day.

- Disbursement: Upon approval, funds will be disbursed directly to the dealership.

Tips to Enhance Approval Chances

- Improve Credit Score: Address any discrepancies and work on improving your credit score.

- Reduce Debt-to-Income Ratio: Aim for a lower ratio by paying down existing debts.

- Increase Income: Additional income sources can bolster your application.

- Provide Accurate Information: Ensure all information provided is accurate and up-to-date.

Truist Bank Auto Loans: How to Qualify, Apply, and Get Approved Faster <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Your Complete Insider Guide to Truist Auto Financing </p>

Truist Bank Auto Loans: How to Qualify, Apply, and Get Approved Faster <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Your Complete Insider Guide to Truist Auto Financing </p>  Regions Bank Auto Loans: Comprehensive Guide to Smart Auto Financing <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Accelerate Your Car Purchase with Confidence </p>

Regions Bank Auto Loans: Comprehensive Guide to Smart Auto Financing <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Accelerate Your Car Purchase with Confidence </p>  How to Apply for a First Tech Federal Credit Union Car Loan: Eligibility & Insider Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> A complete guide to understanding eligibility, hidden benefits, and proven strategies for securing your First Tech Federal Credit Union car loan approval. </p>

How to Apply for a First Tech Federal Credit Union Car Loan: Eligibility & Insider Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> A complete guide to understanding eligibility, hidden benefits, and proven strategies for securing your First Tech Federal Credit Union car loan approval. </p>