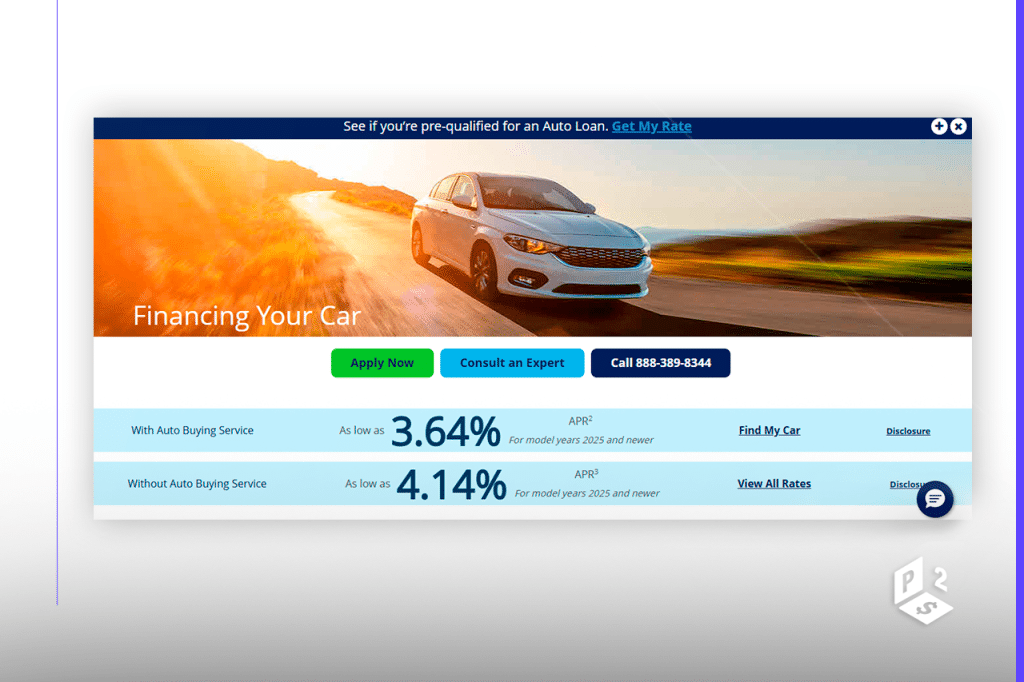

Geico, widely recognized for its affordable auto insurance, extends its commitment to value through competitive auto loan options. Whether you’re purchasing a new or used vehicle, refinancing, or seeking business vehicle loans, Geico’s financing solutions offer attractive rates and flexible terms to suit your needs.

Additional Advantages of Geico Car Financing

1. Flexible Loan Terms

Geico provides a range of loan repayment options, with terms up to 75 months for most vehicles and up to 84 months for brand-new vehicles. This flexibility allows you to choose a repayment plan that aligns with your financial situation. A longer loan term can result in lower monthly payments, easing your budget.

2. No Prepayment Penalties

Unlike some lenders, Geico does not impose prepayment penalties. This means you can pay off your loan early without incurring additional fees, potentially saving on interest costs. Paying off your loan ahead of schedule can be a strategic move to reduce overall debt and improve your credit score.

3. Business Vehicle Loans

For business owners, Geico offers specialized vehicle loans with highly competitive rates and an easy application process. These loans are tailored to meet the unique needs of businesses, helping you acquire the necessary vehicles to operate efficiently.

Eligibility Requirements for Geico Car Financing

To qualify for Geico’s auto loans, ensure you meet the following criteria:

- Credit Score: While Geico does not specify a minimum credit score, a higher score may help secure better rates.

- Income Verification: Proof of stable income is required to demonstrate your ability to repay the loan.

- Employment Status: Being employed or having a consistent source of income is essential.

- Vehicle Criteria: The vehicle being financed must be within 10 model years and/or have 125,000 miles or less. Exceptions may be considered on a case-by-case basis.

- Down Payment: While not always mandatory, a down payment can reduce your loan amount and may improve your chances of approval.

Frequently Asked Questions (FAQ)

Can I apply for a Geico auto loan if I’m not a current Geico customer?

Yes, you can apply for an auto loan with Geico even if you’re not currently a customer. However, being a member may offer additional benefits, such as lower interest rates.

Is there a fee to apply for a Geico auto loan?

There is no application fee for a Geico auto loan. However, fees may apply depending on the state and whether the vehicle is a purchase or refinance.

How long does it take to get approved for a Geico auto loan?

Approval times can vary, but many applicants receive a decision within a few business days. Completing your application accurately and providing all required documentation can expedite the process.

Can I refinance my existing auto loan with Geico?

Yes, Geico offers refinancing options for existing auto loans. Refinancing can potentially lower your interest rate and monthly payments. There are no fees for vehicle refinances.

Step-by-Step Guide to Applying for a Geico Auto Loan

- Visit the Official Website: Go to the Geico Auto Loans page to begin the application process.

- Check Your Eligibility: Review the eligibility criteria to ensure you meet the necessary requirements.

- Gather Required Documents: Prepare documentation such as proof of income, employment verification, and vehicle information.

- Complete the Application: Fill out the online application form with accurate and complete information.

- Submit the Application: Review your application and submit it for processing.

- Await Approval: Geico will review your application and notify you of their decision.

- Finalize the Loan: If approved, finalize the loan agreement and receive the funds.

Tips to Enhance Your Chances of Loan Approval

- Maintain a Good Credit Score: A higher credit score can improve your chances of approval and secure better interest rates.

- Provide Accurate Information: Ensure all information on your application is accurate and complete to avoid delays.

- Demonstrate Stable Income: Providing proof of stable income can reassure lenders of your ability to repay the loan.

- Limit Existing Debt: Reducing existing debt can improve your debt-to-income ratio, a key factor in loan approval.

- Consider a Co-Signer: If you have a limited credit history, a co-signer with a strong credit profile can enhance your application.

Bank of America Auto Loans: Benefits, Requirements & Approval Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock the Full Potential of Your Auto Financing </p>

Bank of America Auto Loans: Benefits, Requirements & Approval Tips <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock the Full Potential of Your Auto Financing </p>  State Farm Car Financing: Complete Guide to Apply & Get Approved <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> How to Maximize Your Benefits and Ensure Approval </p>

State Farm Car Financing: Complete Guide to Apply & Get Approved <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> How to Maximize Your Benefits and Ensure Approval </p>  Ally Auto Financing: A Complete Guide to Securing Your Vehicle <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Exclusive Advantages and Simplify Your Car Purchase </p>

Ally Auto Financing: A Complete Guide to Securing Your Vehicle <p style=' font-weight: normal;font-size: 16px !important; text-align: left;'> Unlock Exclusive Advantages and Simplify Your Car Purchase </p>